GM Electric Van Production Cuts: Company Idles Canadian Plant Through 2025

GM Electric Van Production Cuts: Company Idles Canadian Plant Through 2025

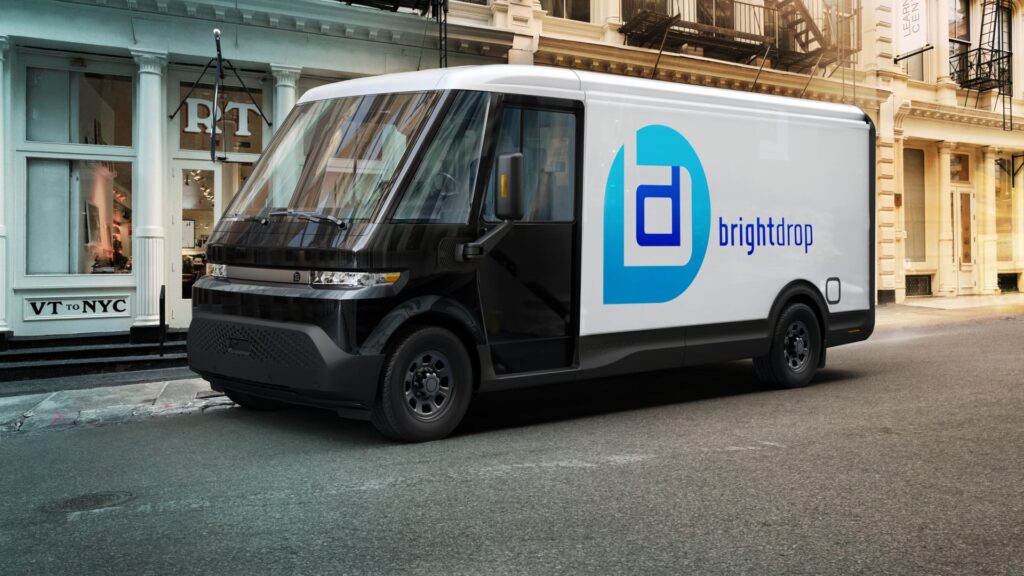

BrightDrop EV600 van production will be significantly reduced as GM announces electric van production cuts at its Canadian facility. Source: BrightDrop

Table of Contents

- GM Electric Van Production Cuts: The Announcement

- CAMI Assembly Plant: Timeline and Impact

- BrightDrop’s Journey: From Subsidiary to Chevrolet Integration

- Market Challenges for Electric Commercial Vehicles

- Unifor Response to GM Electric Van Production Cuts

- Broader Implications for EV Manufacturing

- Future Outlook for GM’s Electric Van Strategy

GM Electric Van Production Cuts: The Announcement

General Motors has announced significant GM electric van production cuts affecting its BrightDrop vehicle manufacturing operations in Canada. The automaker confirmed Friday it will reduce production at its CAMI assembly plant in Ingersoll, Ontario, and idle the facility through much of 2025, eliminating 500 jobs in the process.

The GM electric van production cuts will see the plant transition from two shifts to a single shift. More immediately, the facility will be completely idled beginning in May for approximately 20 weeks, with operations not expected to resume until October. Additionally, battery pack assembly at the plant will be suspended for the weeks of April 21 and April 28, ahead of the extended shutdown.

In an official statement addressing the GM electric van production cuts, the Detroit automaker emphasized that the decision is not related to President Donald Trump’s tariffs but rather represents a strategic adjustment: “This adjustment is directly related to responding to market demand and re-balancing inventory. Production of BrightDrop and EV battery assembly will remain at CAMI.”

Key Points of GM Electric Van Production Cuts

- 500 jobs eliminated at CAMI assembly plant in Ontario

- Plant to be idled from May through October 2025 (approximately 20 weeks)

- Reduction from two shifts to one shift when production resumes

- Battery pack assembly temporarily suspended in late April

- Decision attributed to market demand and inventory rebalancing

CAMI Assembly Plant: Timeline and Impact

The CAMI assembly plant in Ingersoll, Ontario, has been a key facility in GM’s electric vehicle strategy, particularly as it relates to the company’s commercial EV offerings. The plant was converted to produce the all-electric BrightDrop delivery vans as part of GM’s broader commitment to electrification, with the company touting it as Canada’s first full-scale electric vehicle manufacturing plant.

With the announced GM electric van production cuts, workers at the plant face an uncertain future. Hundreds of BrightDrop vehicles have reportedly been lining a storage lot in Flint, Michigan, according to a recent Detroit Free Press report – a visible indication of the inventory challenges that likely contributed to the production decision.

The timeline of the plant idling is significant, as it represents not just a temporary pause but an extended shutdown spanning nearly half a year. This unusually long production halt for the GM electric van manufacturing operation signals deeper challenges in the commercial EV market than the company may have initially anticipated when launching BrightDrop.

BrightDrop electric delivery vans are parked near General Motors BrightDrop unit’s CAMI EV Assembly facility in Ingersoll, Ontario. The plant will be idled as part of GM electric van production cuts. Photo: Carlos Osorio | Reuters

BrightDrop’s Journey: From Subsidiary to Chevrolet Integration

The GM electric van production cuts represent a significant pivot in the company’s strategy for BrightDrop, which has undergone multiple organizational changes since its inception. GM launched BrightDrop as a fully owned subsidiary in 2021, positioning it as an innovative venture targeting the commercial delivery market with purpose-built electric vehicles.

However, the trajectory of BrightDrop changed substantially in the years that followed:

| Year | BrightDrop Organizational Change |

|---|---|

| 2021 | Launched as a fully owned subsidiary of General Motors |

| 2023 | Folded into GM’s fleet business operations |

| 2024 | Integrated into the Chevrolet brand |

| 2025 | Major GM electric van production cuts announced |

The repeated reorganizations leading up to the GM electric van production cuts suggest the company struggled to find the optimal positioning for its commercial EV products. Initially, GM had high expectations for BrightDrop, anticipating it would develop into a lucrative growth business for the automaker. The company had projected BrightDrop would generate $1 billion in revenue in 2023, though GM has declined to disclose whether this target was achieved.

Sales figures paint a concerning picture that helps explain the GM electric van production cuts: across 2023 and 2024 combined, the automaker sold only approximately 2,000 electric vans according to its sales reports – far below what would be needed to sustain full production at the CAMI facility.

Market Challenges for Electric Commercial Vehicles

The GM electric van production cuts reflect broader challenges in the commercial electric vehicle market. Despite strong interest in electrification across the transportation sector, commercial fleet adoption has faced hurdles including infrastructure limitations, initial cost concerns, and operational uncertainties that have slowed the transition from traditional internal combustion vehicles.

For delivery vehicles like the BrightDrop vans, the business case relies on factors including:

- Total cost of ownership advantages over traditional vehicles

- Reliable charging infrastructure for fleet operations

- Range capabilities suited to delivery routes

- Maintenance requirements and service networks

- Integration with existing fleet management systems

The GM electric van production cuts suggest these factors haven’t aligned sufficiently to drive demand at the levels the company initially projected. With hundreds of completed vehicles reportedly sitting in storage in Flint, Michigan, the company appears to be facing a significant mismatch between production capacity and market absorption.

Why Commercial EV Adoption Matters

Commercial vehicles like delivery vans represent a critical segment for electrification due to their predictable routes, high utilization, and significant emissions impact. The GM electric van production cuts could signal broader challenges for reaching commercial fleet electrification targets that many municipalities and corporations have established as part of their sustainability goals.

Unifor Response to GM Electric Van Production Cuts

The Canadian union Unifor, which represents workers at the CAMI assembly plant, responded strongly to the GM electric van production cuts. Lana Payne, president of Unifor, described the production reduction and job eliminations as a “crushing blow to hundreds of working families in Ingersoll and the surrounding region who depend on this plant.”

In her statement regarding the GM electric van production cuts, Payne called for action from both the company and government: “General Motors must do everything in its power to mitigate job loss during this downturn, and all levels of government must step up to support Canadian auto workers and Canadian-made products.”

Unifor explicitly connected international trade dynamics to the situation, despite GM’s statement that the production cuts were not related to tariffs. The union stated that while GM “has indicated it remains committed to the CAMI facility, with upgrades for the 2026 model year, the immediate future remains uncertain without stronger domestic support and fair market access.”

“The reality is the U.S. is creating industry turmoil. Trump’s short-sighted tariffs and rejection of EV technology is disrupting investment and freezing future order projections. This is creating an opening for China and other foreign automakers to dominate the global EV market while the North America industry risks falling behind.”

— Lana Payne, President of Unifor

Broader Implications for EV Manufacturing

The GM electric van production cuts at CAMI come at a pivotal moment for the automotive industry’s electrification efforts. Legacy automakers are navigating the balance between maintaining traditional vehicle production while investing heavily in electric vehicle platforms and manufacturing capacity.

This production adjustment might signal a broader recalibration in how quickly manufacturers can reasonably expect commercial EV adoption to occur. As companies like GM experience slower-than-anticipated demand for electric commercial vehicles, they may need to moderate their production strategies to avoid the inventory imbalances that led to these cuts.

The situation with the GM electric van production cuts also highlights the vulnerability of newer EV programs to market fluctuations. When automakers need to make production adjustments, recently launched EV initiatives often face greater scrutiny than established vehicle programs with proven market demand and profitability.

Future Outlook for GM’s Electric Van Strategy

Despite the significant GM electric van production cuts announced for the CAMI plant, the company has indicated an ongoing commitment to the facility and the BrightDrop program. The company stated that “Production of BrightDrop and EV battery assembly will remain at CAMI,” suggesting this is a temporary adjustment rather than a strategic abandonment of its electric commercial vehicle ambitions.

Unifor noted that GM has indicated plans for upgrades at the facility for the 2026 model year, which could signal a next-generation product or significant improvements to the existing BrightDrop vans. These future plans indicate GM is taking a measured approach – reducing current production to match demand while maintaining the infrastructure and capability for future growth.

For the broader electric commercial vehicle market, the GM electric van production cuts may represent a necessary recalibration rather than a permanent setback. As charging infrastructure improves and fleet operators gain more experience with electric vehicles, demand could accelerate beyond current levels – potentially allowing facilities like CAMI to return to higher production volumes in the future.

The Road Ahead

The GM electric van production cuts reflect current market realities, but the long-term transition to electric commercial vehicles still appears inevitable. For GM, the challenge will be maintaining manufacturing capabilities and market presence through this period of adjustment, ensuring they remain positioned to capitalize when commercial EV adoption accelerates.