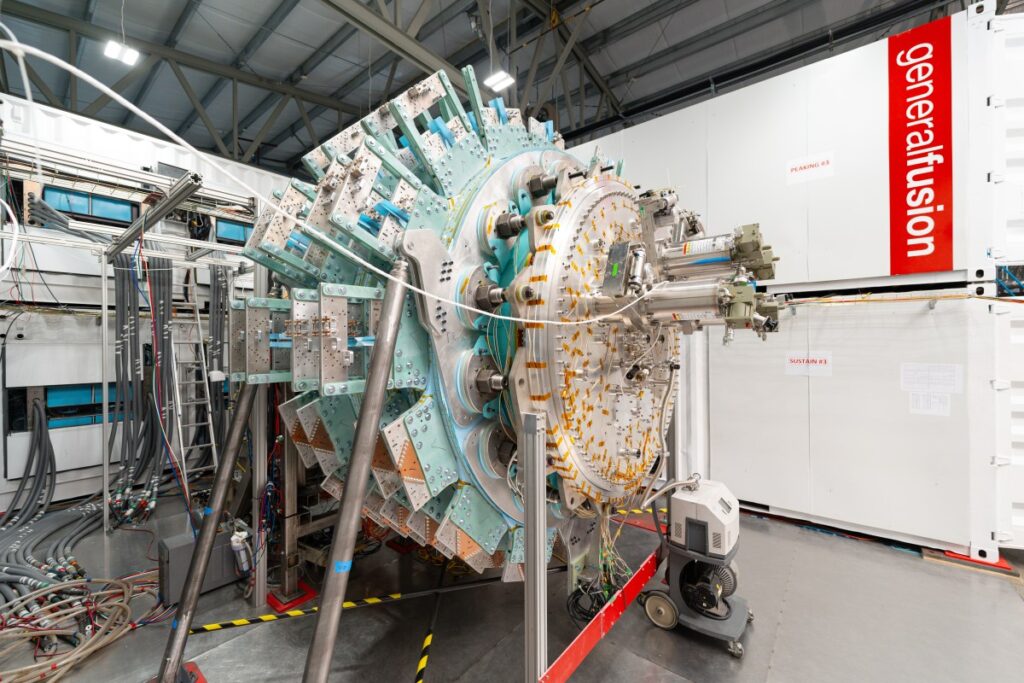

<strong>Image Credits:</strong>General Fusion

General Fusion Layoffs: Financial Crisis Hits Leading Fusion Power Startup

Table of Contents

General Fusion Announces Major Layoffs

General Fusion, one of the world’s leading fusion power startups, has implemented significant layoffs affecting at least 25% of its workforce. This drastic measure came just days after the company achieved a key milestone with its latest fusion demonstration device, the LM26. The timing highlights the precarious financial situation many clean energy startups face despite making technical progress.

In an open letter posted on the company’s website Monday, CEO Greg Twiney acknowledged that while the LM26 device had successfully compressed plasma—a critical step necessary for achieving fusion conditions—General Fusion is experiencing severe financial constraints that necessitated the workforce reduction.

Important Company Statement

“Today’s funding landscape is more challenging than ever as investors and governments navigate a rapidly shifting and uncertain political and market climate,” Twiney wrote in his public statement addressing the company’s situation.

Funding Challenges in the Current Market

The layoffs at General Fusion reflect broader challenges in securing sustained funding for long-term, capital-intensive clean energy technologies. Despite having raised an impressive $440 million over its lifetime, including a recent $22.66 million funding round that closed in July, the company has found itself in a precarious financial position.

General Fusion has attracted investments from high-profile backers including Jeff Bezos, Singapore’s sovereign wealth fund Temasek, and BDC Capital. However, even this substantial financial support has proven insufficient to fully demonstrate the viability of the company’s unique approach to fusion energy generation.

The current economic climate has made it particularly difficult for fusion energy startups to secure the massive capital investments required to bring their technologies to commercial viability. Rising interest rates, market volatility, and shifting investor priorities have all contributed to a more restrictive funding environment for speculative energy technologies with long development timelines.

General Fusion: Canada’s Leading Fusion Contender

Founded 23 years ago, General Fusion has established itself as Canada’s leading competitor in the global race to develop commercial fusion power. Despite its age, many industry observers still categorize it as a startup due to the pre-commercial nature of its technology and its continued reliance on venture funding rather than revenue generation.

The company’s mission has been to develop a practical, cost-effective approach to fusion energy that could eventually deliver clean, abundant electricity to the world’s power grids. Unlike conventional nuclear power, fusion produces minimal radioactive waste and uses widely available fuel sources, making it an attractive potential solution to both energy security and climate change concerns.

Based in Vancouver, General Fusion has been a source of national pride in Canada’s clean technology sector, demonstrating the country’s capacity for innovation in addressing global energy challenges. The current setbacks raise questions about Canada’s ability to maintain a competitive position in the increasingly intense international race to commercialize fusion energy.

Challenges Facing the Fusion Industry

General Fusion’s current predicament underscores the significant technological and financial hurdles confronting the entire fusion power industry. To date, only one fusion device globally has achieved “scientific breakeven”—producing more energy from fusion than was directly used to heat the plasma. While this represents a historic milestone, it remains far from the commercial breakeven point needed for practical power generation.

Commercial viability would require fusion reactors to produce dozens of times more energy than has been demonstrated in any experiment thus far. Achieving this goal demands substantial technological innovations, engineering breakthroughs, and sustained financial investments over many years—possibly decades.

The path to these advanced milestones has proven extraordinarily costly across the industry. Although General Fusion’s fundraising total of $440 million appears substantial, it actually places the company in the middle tier of well-funded fusion startups.

| Fusion Company | Total Funding | Notable Backers |

|---|---|---|

| Commonwealth Fusion Systems | Over $2 billion | Bill Gates, Google, Breakthrough Energy Ventures |

| Helion Energy | Over $1 billion | Sam Altman, Microsoft, Dustin Moskovitz |

| Pacific Fusion | $900 million (Series A) | Major energy conglomerates, venture capital firms |

| General Fusion | $440 million | Jeff Bezos, Temasek, BDC Capital |

General Fusion’s Unique Technical Approach

Part of General Fusion’s challenge in attracting sufficient funding stems from its distinctive technical approach, which differs significantly from the methodologies pursued by most competitors in the fusion energy space. The company has chosen a path less traveled, which creates both opportunities and obstacles.

Most fusion energy startups follow one of two established approaches: magnetic confinement or inertial confinement. Magnetic confinement uses powerful magnetic fields to control and compress plasma until conditions are sufficient for fusion reactions to occur. Inertial confinement typically employs high-powered lasers to rapidly compress a fuel pellet to extreme densities and temperatures.

General Fusion, however, has pioneered an alternative method using steam-driven pistons to compress fusion fuel—a technique sometimes referred to as magnetized target fusion. This approach combines elements of both mainstream methods but relies on mechanical compression rather than purely magnetic or laser-based systems.

Technical Background

The U.S. Navy experimented with a similar compression approach in the 1970s without success, but General Fusion believes modern computational capabilities and advanced materials can overcome the timing and synchronization problems that hindered earlier attempts.

The company has maintained that if completed as designed, the LM26 demonstration device should be capable of reaching scientific breakeven—the important milestone where fusion energy output equals the direct energy input used to heat the plasma. Achieving this goal would significantly validate General Fusion’s approach and potentially attract renewed investor interest.

How General Fusion Compares to Competitors

The global race to develop viable fusion energy has intensified in recent years, with several well-funded competitors pursuing different technical approaches. Each company faces unique challenges, but all require enormous capital investment to progress toward commercial viability.

Commonwealth Fusion Systems (CFS), the industry’s funding leader with over $2 billion raised, is developing a compact tokamak design using high-temperature superconducting magnets. This approach builds on decades of research with tokamak devices while introducing novel magnet technology to reduce size and cost.

Helion Energy, which has secured over $1 billion in funding, is developing a pulsed non-ignition fusion system that directly converts fusion energy to electricity without thermal conversion. The company has a power purchase agreement with Microsoft, demonstrating early commercial interest in its technology.

Newer entrant Pacific Fusion has secured an extraordinary $900 million Series A commitment to pursue its approach, signaling continued investor appetite for fusion technologies despite the challenges. This substantial early-stage funding provides Pacific Fusion with resources that General Fusion, despite its longer history, has been unable to match.

Fusion Industry Strategy

Several fusion startups have secured major corporate partnerships and power purchase agreements to provide long-term funding stability. These strategic alliances with major energy users or providers offer both financial security and potential commercialization pathways that pure venture funding cannot.

Future Prospects and Next Steps

For General Fusion, the immediate priority is clear: secure additional funding quickly to maintain operations and continue development of the LM26 device. The recent layoffs, while painful, may help extend the company’s runway as it pursues new investment opportunities.

The company faces several potential paths forward. It could seek emergency bridge funding from existing investors, pursue new strategic partnerships with energy companies or governments, or potentially consider acquisition by a larger entity with deeper resources. Each option presents tradeoffs between independence, control of intellectual property, and financial stability.

The recent achievement of plasma compression with the LM26 device provides a technical milestone that may help the company make its case to potential investors. However, competition for fusion funding has intensified, with many investors preferring to back companies that have already secured substantial funding or demonstrated more significant technical progress.

Conclusion

General Fusion’s current challenges reflect the broader difficulties facing the fusion energy industry as it attempts to transition from scientific research to commercial viability. Despite raising $440 million over its 23-year history, the company now finds itself in a precarious financial position, forced to reduce its workforce by at least 25% even as it achieves technical milestones.

The company must now raise additional capital quickly if it hopes to complete development of its LM26 device and prove that its unique approach to fusion energy represents a viable path to clean, abundant power. The outcome of this effort will not only determine General Fusion’s future but also influence the broader landscape of fusion energy development and Canada’s position in the global race for this transformative technology.