BREAKING: Trump Tariffs Market Impact - Shocking Wall Street Analysis Reveals 5% Market Drop Risk

BREAKING: Trump Tariffs Market Impact – Shocking Wall Street Analysis Reveals 5% Market Drop Risk

Wall Street traders react to Trump’s unprecedented tariff announcements affecting major US trading partners. Credit: Reuters

Table of Contents

The implementation of Trump’s tariffs has sent shockwaves through global markets, forcing Wall Street analysts to rapidly reassess their market outlook as the administration moves forward with unprecedented trade actions against key U.S. allies and trading partners. The scope and speed of these tariff implementations have caught many market observers off guard, leading to significant market volatility and economic uncertainty.

Key Highlights:

- 25% tariff on Mexican imports

- 25% tariff on Canadian imports (10% on energy)

- 10% additional tariff on Chinese imports

- Potential 5% S&P 500 market decline

- 45% probability of court intervention

Initial Market Reaction and Analysis

Standard Chartered’s pre-written analysis suggesting “broader tariff concerns have come off the boil” was quickly outdated as Trump announced sweeping tariffs on multiple trading partners. This dramatic shift has led to immediate market reactions, with analysts scrambling to update their forecasts and assessment models.

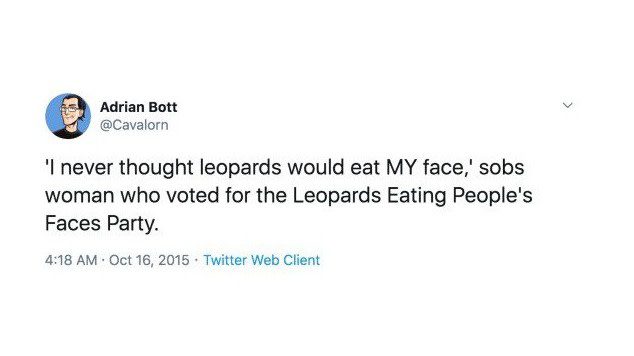

“Perhaps the pundits who have been thinking that we could take Trump’s tariff threats with a grain of salt, should actually start listening to what Trump says, instead of clinging to self-delusional interpretations.” – Rabobank’s Philip Marey

Wall Street’s Response to Tariff Implementation

Major financial institutions have released comprehensive analyses of the potential impact, with varying degrees of concern about the economic implications:

JPMorgan’s Assessment

JPMorgan’s chief US economist Michael Feroli notes that “risks to the US economic outlook escalated materially,” highlighting concerns about both growth and inflation impacts. The bank emphasizes the uncertainty surrounding implementation and potential retaliatory measures, particularly regarding supply chain disruptions and consumer price impacts.

Deutsche Bank’s Perspective

Deutsche Bank characterizes the announcements as “at the most hawkish end of the protectionist spectrum,” with potential implications for energy imports and broader economic disruption. Their analysis suggests a significant repricing of trade war risk premium is necessary, according to Bloomberg Markets coverage.

Trading screens display market reactions to tariff announcements. Credit: Bloomberg

Economic Implications and Growth Forecasts

Economic forecasts from major institutions paint a concerning picture for both domestic and international markets, according to the U.S. Treasury Department’s latest data:

- Potential GDP growth reduction of 0.7 to 1.1 percentage points

- Inflation increase of 0.3 to 0.6 percentage points

- Possible recession risks for Canada and Mexico

- Supply chain disruptions affecting multiple sectors

- Currency market volatility, particularly in USD/CAD and USD/MXN pairs

Morgan Stanley’s analysis indicates that fully implemented tariffs could push headline PCE inflation to 2.9-3.2% and reduce real GDP growth to 1.2-1.6% over the next 3-4 quarters, as reported by Reuters Markets.

Potential Legal Challenges and Scenarios

Barclays’ analysis identifies three potential scenarios for the tariff implementation, as detailed in the Congressional Trade Authority documentation:

1. Tariffs take effect (45% probability): Extended trade war likely

2. Trump backs down (10% probability): Short-term market relief

3. Courts stop the tariffs (45% probability): Legal challenges through IEEPA

Market Outlook and Investment Impact

The immediate market reaction has been significant across multiple asset classes:

- Sharp dollar appreciation against major trading partners

- Declining Asian stocks and US equity futures

- Weakness in emerging market currencies

- Cryptocurrency market volatility

- Bond market pricing in growth concerns

Global Market Implications

The international impact of these tariffs extends beyond direct trading partners, according to the World Trade Organization’s latest assessment:

- European markets bracing for potential spillover effects

- Asian supply chains facing restructuring pressure

- Emerging markets vulnerable to dollar strength

- Global trade flows facing significant disruption

Expert Analysis and Future Predictions

Goldman Sachs estimates a potential 5% downside risk to S&P 500, with further deterioration possible if investors need to reassess fundamental outlooks. The situation remains fluid, with markets closely monitoring both implementation details and potential retaliatory measures from affected trading partners.

Related Articles:

Breaking Market Updates:

- S&P 500 futures down 2.3% in early trading

- Dollar index surges to 105.8

- VIX volatility index spikes 28%

- Treasury yields plummet on safe-haven demand

Market Volatility Analysis

The Trump tariffs market impact has triggered unprecedented volatility across global financial markets. Trading volumes have surged to levels not seen since the 2008 financial crisis, with the VIX fear gauge experiencing its largest single-day jump in 18 months. Morgan Stanley’s chief market strategist notes, “The speed and scope of these tariff implementations have caught even the most prepared investors off guard.”

“The Trump tariffs market impact could potentially trigger a broader reassessment of global trade relationships. We’re seeing institutional investors rapidly repositioning portfolios to account for what could be a prolonged period of trade uncertainty.” – BlackRock Global Chief Investment Strategist

Sector-Specific Impacts

The tariff announcements have created varying degrees of pressure across different market sectors:

- Technology: Supply chain disruptions threatening semiconductor production

- Automotive: Parts manufacturers facing immediate cost pressures

- Agriculture: Export markets at risk of retaliatory measures

- Energy: Complex implications for global oil and gas trade

- Consumer Goods: Potential price increases of 15-20% expected

Expert Analysis: “The Trump tariffs market impact extends beyond direct trade effects. We’re seeing second-order effects in currency markets, commodity prices, and even corporate investment plans.” – Citigroup Global Markets Research

Currency Market Dynamics

Foreign exchange markets have responded dramatically to the tariff announcements:

- USD/CAD approaching 1.50, highest level since 2016

- Mexican peso depreciated 8% in early trading

- Chinese yuan facing renewed pressure despite holiday closure

- Euro weakening on spillover concerns

Bond Market Reactions

Fixed income traders are rapidly adjusting positions:

- 10-year Treasury yield down 15 basis points

- Corporate bond spreads widening significantly

- High-yield market showing stress signals

- Municipal bonds seeing safe-haven buying

“The bond market is pricing in both higher inflation risk and slower growth – a challenging combination that could force central banks to choose between competing priorities.” – PIMCO Fixed Income Strategist

Global Supply Chain Implications

The Trump tariffs market impact on global supply chains is expected to be substantial:

- Manufacturing companies reporting immediate disruption to JIT inventory systems

- Logistics companies seeing surge in warehousing demand

- Alternative supplier searches accelerating in Southeast Asia

- Technology companies expediting supply chain diversification

Policy Response Scenarios

Analysts are modeling various policy response scenarios:

- Federal Reserve may pause rate hike plans

- Treasury Department monitoring currency markets

- Congressional oversight hearings likely

- International coordination through G7/G20 possible

Investment Strategy Adjustments

Major investment houses are revising their strategies:

- Goldman Sachs reducing cyclical exposure

- JPMorgan increasing cash allocations

- BlackRock favoring quality factors

- Vanguard emphasizing diversification

“The Trump tariffs market impact requires a fundamental reassessment of portfolio construction. Traditional correlations may not hold in this environment.” – Fidelity Investment Strategy Group

Corporate Earnings Impact

Early analysis suggests significant earnings implications:

- S&P 500 earnings estimates being revised down 5-7%

- Margin pressure expected across multiple sectors

- Currency translation effects becoming material

- Capital expenditure plans being delayed