Tax Return Filing Guide 2025: Complete IRS Income Requirements

Stay compliant with the latest IRS guidelines for income reporting in 2025

Hey there! Let me tell you something that blew my mind when I first started working as a tax advisor: the IRS processed over 240 million tax returns in 2024, and yet nearly 1.4 million people still managed to miss reporting some form of income! ? Trust me, I’ve been there – back in my early days, I totally forgot to report my side gig income from online tutoring, and boy, was that a learning experience!

Look, I get it – tax season can feel like trying to solve a Rubik’s cube blindfolded. But after 15 years of helping folks figure out their tax situations, I’ve learned that understanding what income you need to report doesn’t have to be rocket science. Whether you’re making money from a traditional 9-to-5, selling stuff online, or doing freelance work from your couch (hello, digital age!), I’m here to break it all down in plain English.

Quick heads up: the tax landscape is changing faster than my teenager’s social media habits! With new IRS requirements for 2025 and that whole Form 1099-K situation (which, trust me, we’ll get into), you’ll want to pay extra attention this year. Let’s get you sorted out!

Table of Contents

Understanding Taxable Income

A comprehensive overview of various types of taxable income you need to report

What is Taxable Income?

Let me tell you a funny story – when I first started teaching tax basics, I had a student who thought only their “main job” counted as taxable income. They were shocked when I explained that those $500 they made selling vintage clothes online needed to be reported too! Taxable income is basically any money you receive that isn’t specifically exempt by law, and trust me, the IRS casts a pretty wide net here.

Think of taxable income like a big umbrella – it covers way more than just your regular paycheck. We’re talking wages, tips (yes, all those cash tips too!), freelance earnings, rental income, and even some social media influencer perks (those free products you get? Yep, might need to report those!). I learned this the hard way when I didn’t report some freelance writing income back in 2010 – let’s just say the IRS notice I got wasn’t exactly a love letter! ?

Here’s something that might surprise you – even illegal income is technically supposed to be reported (though I definitely don’t recommend testing that one out!). The key thing to remember is that if it puts money in your pocket, Uncle Sam probably wants to know about it. And with the new Form 1099-K requirements for 2025, even those small side hustles through payment apps might need to be reported.

Quick Reference: Common Types of Taxable Income

- ✅ Wages and salaries from employers

- ✅ Tips and gratuities

- ✅ Self-employment earnings

- ✅ Investment income (interest, dividends)

- ✅ Rental income

- ✅ Online sales profits

- ✅ Cryptocurrency gains

- ✅ Gig economy earnings

What Types of Income Must Be Reported?

Oh boy, this is where things get interesting! I remember when one of my clients came to me, totally panicked because she didn’t know she had to report the income from her YouTube channel. She thought because it was just a “hobby,” it didn’t count. Plot twist: it definitely counted! Let me break down the different types of income you need to report, and trust me, there are more than you might think.

Employment Income

- ? Regular wages (W-2 income)

- ? Bonuses and commissions

- ? Tips (yes, even cash tips!)

- ? Severance pay

Digital and Online Income

- ? Online marketplace sales (eBay, Etsy, etc.)

- ? Social media earnings

- ? Digital product sales

- ? Cryptocurrency transactions

Gig Economy and Freelance Work

- ? Rideshare driving

- ? Food delivery services

- ? Freelance writing/design

- ? Consulting fees

Investment Income

- ? Interest earnings

- ? Stock dividends

- ? Capital gains

- ? Rental property income

Here’s a pro tip I learned after years of dealing with the IRS: if you’re not sure whether something counts as reportable income, it probably does! I’ve seen too many folks get into hot water because they thought their side hustle was too small to matter. Fun fact: the IRS doesn’t really care about the size – they care about accuracy!

⚠️ New for 2025: Payment App Reporting

Listen up, because this is super important! Starting in 2025, payment apps like PayPal, Venmo, and Cash App will be required to report transactions totaling over $600 to the IRS. This is a huge change from the previous $20,000 threshold. Check out our detailed guide on payment app tax reporting for more information.

Real-World Example

Let me share a quick story about Sarah (not her real name, of course!). She started selling handmade jewelry on Etsy as a hobby. In her first year, she made about $5,000 but didn’t report it because she thought she needed to make at least $10,000 for it to “count.” The IRS sent her a notice the following year because Etsy had reported her earnings. Not only did she have to pay the taxes, but she also got hit with penalties. Don’t be like Sarah – report everything!

Are There Any Exceptions to Reporting Income?

Alright, here’s where I get to share some good news! Not everything that puts money in your pocket needs to be reported to the IRS. I remember doing a happy dance with a client when we realized her scholarship money was tax-free because it went directly to tuition. Let’s break down what you can keep off your tax return (legally, of course!).

Common Non-Taxable Income Sources

- ? Life insurance proceeds

- ? Most health insurance benefits

- ? Inherited property (in most cases)

- ? Child support payments

- ? Welfare benefits

- ? Qualifying scholarships

- ? Gift money (up to annual exclusion)

- ? Roth IRA qualified distributions

? Pro Tip: Gift Reporting

Here’s something that trips up a lot of my clients: while receiving a gift isn’t taxable income, giving large gifts might require filing a gift tax return. For 2025, you can give up to $18,000 per person without reporting it. I once had a client who sold his car to his son for $1 – guess what? The difference between the fair market value and that $1 was considered a gift!

But here’s the thing – and I always tell my clients this – just because something might be non-taxable doesn’t mean you shouldn’t keep records. The IRS loves documentation, and in case of an audit, you’ll want to prove why you didn’t report certain income. Trust me, I’ve seen enough audits to know that good records are like a security blanket!

Real-World Example: The Scholarship Situation

I had a graduate student come to me in tears because she thought she needed to report her entire $50,000 scholarship as income. After we reviewed the details, we found that $45,000 went directly to tuition and qualified expenses (not taxable), while only $5,000 was for living expenses (taxable). She saved thousands in taxes just by understanding this exception! This is why I’m so passionate about helping people understand these distinctions.

⚠️ Common Misconception Alert!

Just because income isn’t taxable doesn’t mean you shouldn’t tell your tax preparer about it. Some non-taxable income can affect other calculations on your tax return or might need to be reported even if it’s not taxed. When in doubt, bring it up – we’d rather know too much than too little!

Who is Required to File a Tax Return?

Key dates and requirements for filing your 2025 tax return

What is the Minimum Income Requirement for Filing?

Let me tell you about the time I had a college student walk into my office, convinced they didn’t need to file taxes because they “only” made $12,000 from their part-time job. Plot twist: they were self-employed as a social media manager, which meant they needed to file even though they were under the standard filing threshold. Yikes! Let’s break down exactly who needs to file so you don’t make the same mistake.

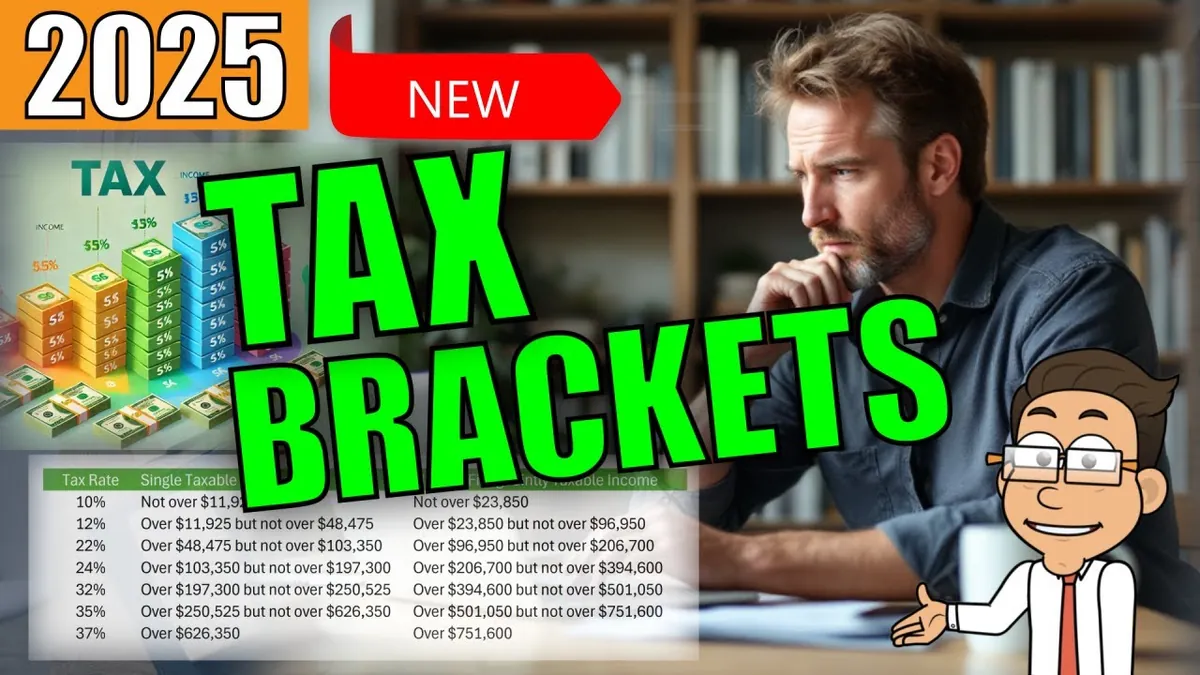

2025 Filing Requirements by Filing Status

| Filing Status | Age | Minimum Income |

|---|---|---|

| Single | Under 65 | $13,850 |

| Single | 65 or older | $15,700 |

| Married Filing Jointly | Both under 65 | $27,700 |

| Head of Household | Under 65 | $20,800 |

⚠️ Important Exception!

Here’s the kicker that catches many of my clients off guard: if you’re self-employed and made more than $400 net earnings, you MUST file a tax return regardless of your age or total income. This includes all those side hustles – yes, even your weekend dog-walking gig!

How Do Filing Status and Age Affect Your Requirement to File?

Oh boy, this is where things get interesting! Your filing status is like choosing your character in a video game – each one comes with different powers (or in this case, thresholds and benefits). I once had a client who could have saved thousands by filing as Head of Household instead of Single, but she didn’t know she qualified!

? Filing Status Pro Tips

- ? Single? You might qualify for Head of Household if you support a qualifying person

- ? Recently divorced? Your status is determined on the last day of the tax year

- ? Widowed? You might be eligible for Qualifying Widow(er) status for two years after your spouse’s death

- ? Married? Compare both joint and separate filing to see which benefits you more

Are There Special Considerations for Dependents?

Let me share a story that still makes me shake my head. I had a teenage client who made $12,000 from their YouTube channel but didn’t file because their parents claimed them as a dependent. Big mistake! Dependent status doesn’t exempt you from filing – it just changes the rules a bit.

2025 Filing Requirements for Dependents

You must file a return if your earned income is more than:

- ? Earned income more than $12,950

- ? Unearned income more than $1,150

- ? Gross income more than the larger of:

- – $1,150

- – Earned income (up to $12,550) plus $350

Real-World Example: The Social Media Star

Remember that teenage YouTuber I mentioned? Their situation got even more complicated because they were receiving both ad revenue (earned income) and sponsorship gifts (unearned income). We had to carefully separate these income streams to determine their filing requirement. The lesson? When in doubt, keep track of EVERYTHING!

Common Types of Income to Report

Do You Need to Report Wages and Salaries?

You know what makes me chuckle? When clients come in with their W-2s neatly organized but completely forget about that holiday bonus or those overtime payments. Listen, if your employer paid you for anything – and I mean anything – it needs to go on your tax return. Let me break this down in a way that’ll make total sense.

Must-Report Employment Income

- ✅ Regular wages and salary

- ✅ Overtime pay

- ✅ Bonuses and commissions

- ✅ Tips (cash and credit card)

- ✅ Severance pay

- ✅ Back pay

- ✅ Accumulated sick leave

- ✅ Holiday gifts from employer (if cash or cash equivalent)

? Tip Income Alert!

Here’s something that got one of my restaurant server clients in hot water: ALL tips are taxable, even cash tips! The IRS has some pretty sophisticated ways of estimating tip income based on credit card sales, so it’s better to report accurately than risk an audit. Pro tip: keep a daily tip diary – your future self will thank you!

What About Self-Employment Income?

Oh boy, this is where things get spicy! ?️ Self-employment income is like a whole different ball game. I had a client who thought she only needed to report her “main” freelance gig and could ignore her smaller side hustles. Spoiler alert: the IRS wants to know about ALL of it!

Self-Employment Income You Must Report

- ? Freelance work (even one-time gigs!)

- ? Online platform earnings (Uber, DoorDash, etc.)

- ? Consulting fees

- ? Social media influencer income

- ? Online course sales

- ? Digital product revenue

- ? Commission-based sales

- ? Personal service income (coaching, tutoring, etc.)

⚠️ New Form 1099-K Rules for 2025

Starting in 2025, if you receive $600 or more through payment apps like PayPal, Venmo, or Cash App for goods or services, you’ll get a Form 1099-K. This is HUGE change from the previous $20,000 threshold. I’ve been telling all my clients to start keeping better records NOW, because this is going to affect a lot of side hustlers!

Real-World Example: The Accidental Business Owner

Meet Tom (not his real name), who started selling custom t-shirts online “just for fun.” He made $8,000 in his first year but didn’t think he needed to report it because it was “just a hobby.” Well, the IRS had different ideas! Not only did he have to pay self-employment tax, but he also missed out on some sweet business deductions because he wasn’t keeping proper records. Don’t be like Tom – track everything from day one!

Should You Report Investment Income and Capital Gains?

Let me tell you about the time a client walked in with a shoebox full of crypto trading receipts and a confused look on their face. “But I thought if I didn’t cash out to my bank account, it doesn’t count!” Oh honey, let me explain how investment income really works…

Types of Investment Income to Report

- ? Stock market gains and losses

- ? Cryptocurrency transactions

- ? Dividend payments

- ? Interest income

- ? Rental property income

- ? Capital gains distributions from mutual funds

- ? NFT sales (yes, really!)

? Crypto Trading Tip

Listen up, crypto traders! Every single trade is a taxable event – yes, even crypto-to-crypto trades. I recommend using a crypto tax tracking software because trying to calculate this manually is like trying to count grains of sand on a beach. Trust me, I’ve seen the tears of those who tried!

Non-Taxable Income: What Should You Know?

What Types of Income Are Considered Non-Taxable?

Alright, here’s some good news for a change! Not everything that puts money in your pocket needs to be reported to Uncle Sam. I remember the relief on my client’s face when I told her that the life insurance payout she received after her husband’s passing wasn’t taxable. Let’s dive into what you can keep off your tax return (legally, of course!).

Common Non-Taxable Income Sources

- ? Life insurance proceeds

- ? Child support payments

- ? Welfare benefits

- ? Municipal bond interest

- ? Roth IRA qualified distributions

- ? Veterans’ benefits

- ? Workers’ compensation

- ? Disability benefits (in most cases)

Real-World Example: The Scholarship Winner

I had a graduate student nearly have a heart attack thinking she needed to report her entire $50,000 scholarship as income. After we reviewed the details, we found that $45,000 went directly to qualified educational expenses (not taxable), while only $5,000 for living expenses needed to be reported. She saved thousands in taxes just by understanding this distinction!

How Do Gifts and Inheritances Affect Your Tax Reporting?

This is where things get interesting! I once had a client panic because his grandma gave him $10,000 for his wedding. He was ready to report it as income until I explained that gifts aren’t taxable to the receiver. The person giving the gift might need to file a gift tax return, but that’s their responsibility, not yours!

? Gift and Inheritance Guidelines

- ? Gifts received are generally not taxable income

- ? 2025 annual gift exclusion: $18,000 per person

- ? Inherited property usually isn’t taxable income

- ? But… income from inherited property is taxable

How to Report Your Income

Overview of different tax forms and reporting requirements for various income types

What Forms Do You Need to Report Different Types of Income?

Oh my goodness, the number of times I’ve seen clients show up with a shoebox full of random papers! ? Let’s get you organized with a clear breakdown of which forms you need for different types of income. Trust me, the IRS loves it when everything’s in its right place!

Common Tax Forms Guide

| Income Type | Form | What to Look For |

|---|---|---|

| Employment Income | W-2 | Arrives by January 31 |

| Freelance/Contract Work | 1099-NEC | $600+ earnings per client |

| Payment App Income | 1099-K | $600+ in 2025 |

| Investment Income | 1099-DIV/INT | Dividends and interest |

⚠️ Missing Forms Alert!

Here’s a rookie mistake I see all the time: waiting for forms that aren’t coming! If you earned less than $600 from a client, they’re not required to send you a 1099. But guess what? You still need to report that income! I always tell my clients: “The IRS doesn’t care if you got a form or not – they care about accurate reporting.”

How Do You Keep Track of All Income Sources?

Let me share a story that’ll make you laugh (or cry). I had a client who tried to track his freelance income by keeping all his cash in different sock drawers – one for each client! ? While points for creativity, there are much better ways to track your income. Here’s what I recommend to all my clients:

? Income Tracking Best Practices

- ? Use a dedicated business bank account

- ? Keep digital records of all transactions

- ? Use accounting software for business income

- ? Save digital copies of all tax forms

- ? Track mileage and expenses separately

- ? Set aside tax money as you earn it

Real-World Example: The Digital Nomad

One of my favorite success stories is about a digital nomad who was earning income from six different countries through various platforms. She implemented a simple spreadsheet system, categorizing income by source, currency, and tax status. When tax time came around, she was the most prepared client I had that year! The key? She tracked everything in real-time, not just at tax season.

What Happens if You Fail to Report Income?

Learn about potential consequences and penalties for failing to report income to the IRS

What Are the Consequences of Not Reporting Income?

Okay, story time! I once had a client who “forgot” to report $20,000 in freelance income because they were paid in cash. Fast forward two years, and they got a not-so-friendly letter from the IRS with a bill that made their eyes water! ? Let’s talk about what happens when income goes unreported, and trust me, it’s not pretty.

⚠️ Potential Consequences

- ❌ Accuracy-related penalty: 20% of the underpayment

- ❌ Interest charges on unpaid taxes

- ❌ Possible criminal charges for tax evasion

- ❌ Audit risk increases significantly

- ❌ Can affect future loan applications

- ❌ May impact social security benefits

Real-World Example: The Costly Mistake

Let me tell you about Maria (not her real name). She didn’t report $5,000 from her side gig thinking it was too small to matter. The IRS caught it through payment app reporting. Original tax owed? About $750. After penalties and interest? Over $2,000! Plus, she had to hire me to help sort it out, which added to her costs. The lesson? Report everything – it’s cheaper in the long run!

How Does the IRS Detect Unreported Income?

You wouldn’t believe how sophisticated the IRS has become at finding unreported income! Gone are the days when cash transactions could easily fly under the radar. I had a client who was shocked when the IRS knew about their online craft sales – turns out, payment processors are telling all! ?️♂️

How the IRS Finds Unreported Income

- ? Information matching with 1099s and W-2s

- ? Bank deposit analysis

- ? Payment processor reports (PayPal, Stripe, etc.)

- ? Social media monitoring for business activity

- ? Tips from whistleblowers

- ? Lifestyle analysis

- ? Cross-reference with state tax returns

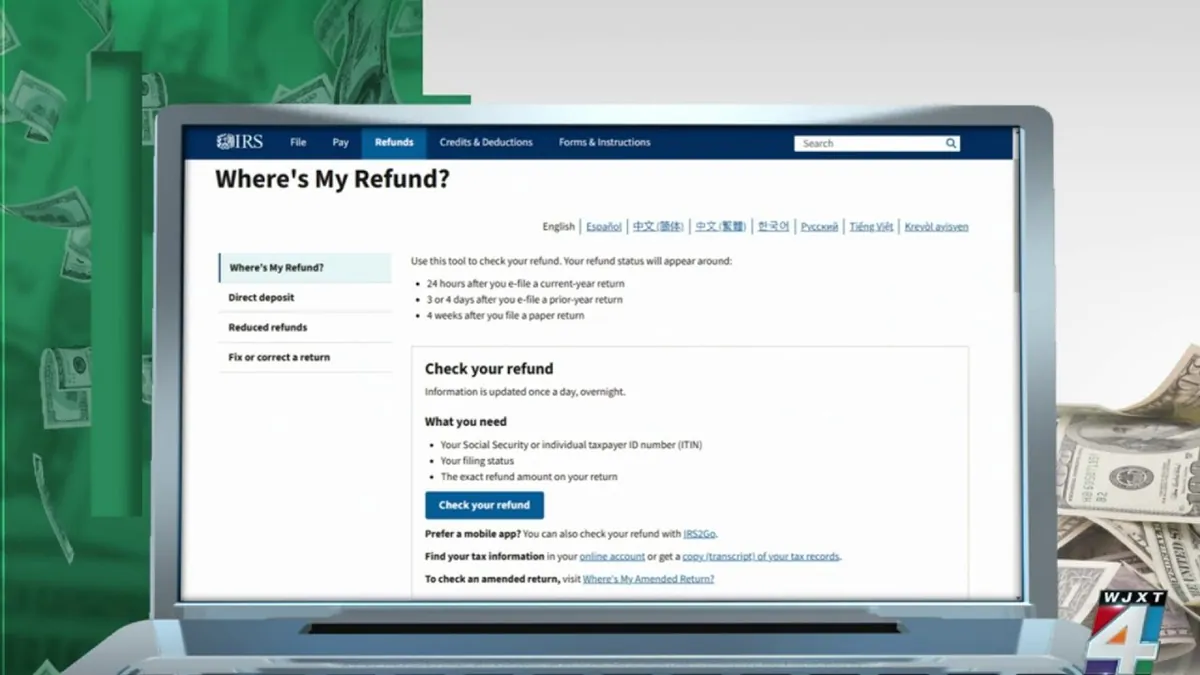

? Prevention is Better Than Cure

Want to know the best way to handle unreported income? Report it before the IRS finds it! If you discover you’ve missed something, file an amended return (Form 1040-X) as soon as possible. The IRS tends to be more lenient with voluntary corrections than when they catch the error themselves.

Resources for Understanding IRS Guidelines

Listen, I get it – tax stuff can be overwhelming! But you’re not in this alone. I’ve spent years helping people navigate the maze of tax regulations, and I’m going to share my favorite resources that actually make sense (and won’t put you to sleep! ?).

Essential IRS Resources

- ? IRS Website (irs.gov): Your first stop for official guidance

- ? Publication 17: The bible of individual tax returns

- ? Interactive Tax Assistant: Answer questions to get personalized guidance

- ? Tax Withholding Estimator: Avoid surprises at tax time

? Free Tax Help Programs

- ? VITA (Volunteer Income Tax Assistance) for incomes under $60,000

- ? TCE (Tax Counseling for the Elderly) for those 60+

- ? IRS Taxpayer Advocate Service for difficult situations

- ? Local tax workshops and seminars

Success Story: The Self-Taught Tax Pro

One of my clients, a food truck owner, took it upon herself to learn everything about food service taxation. She used IRS resources, attended workshops, and even joined online communities. Not only did she save money on professional fees, but she also helped other food truck owners in her area understand their tax obligations. Now that’s what I call turning tax knowledge into community power! ?

⚠️ Stay Updated!

Tax laws change faster than my teenager’s social media habits! Make sure you’re getting updates from reliable sources. Follow the IRS on social media, subscribe to tax newsletters, or better yet, bookmark the IRS news page. Knowledge is power, especially when it comes to taxes!

Frequently Asked Questions

Do I need to report income from my side hustle?

Yes! If you earned more than $400 in net self-employment income, you must report it. This includes income from online sales, freelance work, gig economy jobs, and any other side hustles.

What happens if I forgot to report some income?

File an amended return (Form 1040-X) as soon as possible. The IRS is usually more lenient with voluntary corrections than when they discover unreported income themselves.

Do I need to report cash tips?

Absolutely! All tips, whether cash or credit card, are taxable income. Keep a daily tip diary to track your earnings accurately.

How long should I keep my income records?

Keep records for at least 3 years from the date you filed your return or 2 years from the date you paid the tax, whichever is later. For self-employed individuals, keeping records for 7 years is recommended.

What’s changing with payment app reporting in 2025?

Starting in 2025, payment apps must report to the IRS when you receive $600 or more for goods and services (down from the previous $20,000 threshold). This includes payments through PayPal, Venmo, Cash App, and similar platforms.

Key Takeaways

- ✅ Report all income sources – whether from traditional employment, online sales, or side gigs

- ✅ Keep detailed records – maintain documentation for all income throughout the year

- ✅ Stay updated on requirements – especially the new $600 reporting threshold for payment apps in 2025

- ✅ Use available resources – take advantage of IRS tools and free tax help programs

- ✅ When in doubt, report it – it’s better to report unnecessary income than miss required reporting

Conclusion

Listen, I know taxes aren’t exactly the most exciting topic (unless you’re a tax nerd like me! ?), but understanding your income reporting obligations is crucial in today’s digital economy. Whether you’re a traditional employee, side hustler, or full-time digital entrepreneur, staying on top of your tax game can save you from headaches (and wallet-aches) down the road.

Remember, the IRS isn’t out to get you – they just want accurate reporting. Keep good records, stay informed about changes (especially that new $600 reporting threshold coming in 2025!), and when in doubt, reach out to a tax professional. Your future self will thank you!

Got questions about your specific tax situation? Drop them in the comments below! And hey, if this guide helped you understand your tax obligations better, share it with your friends and family – because nobody should have to learn about tax reporting the hard way! ?